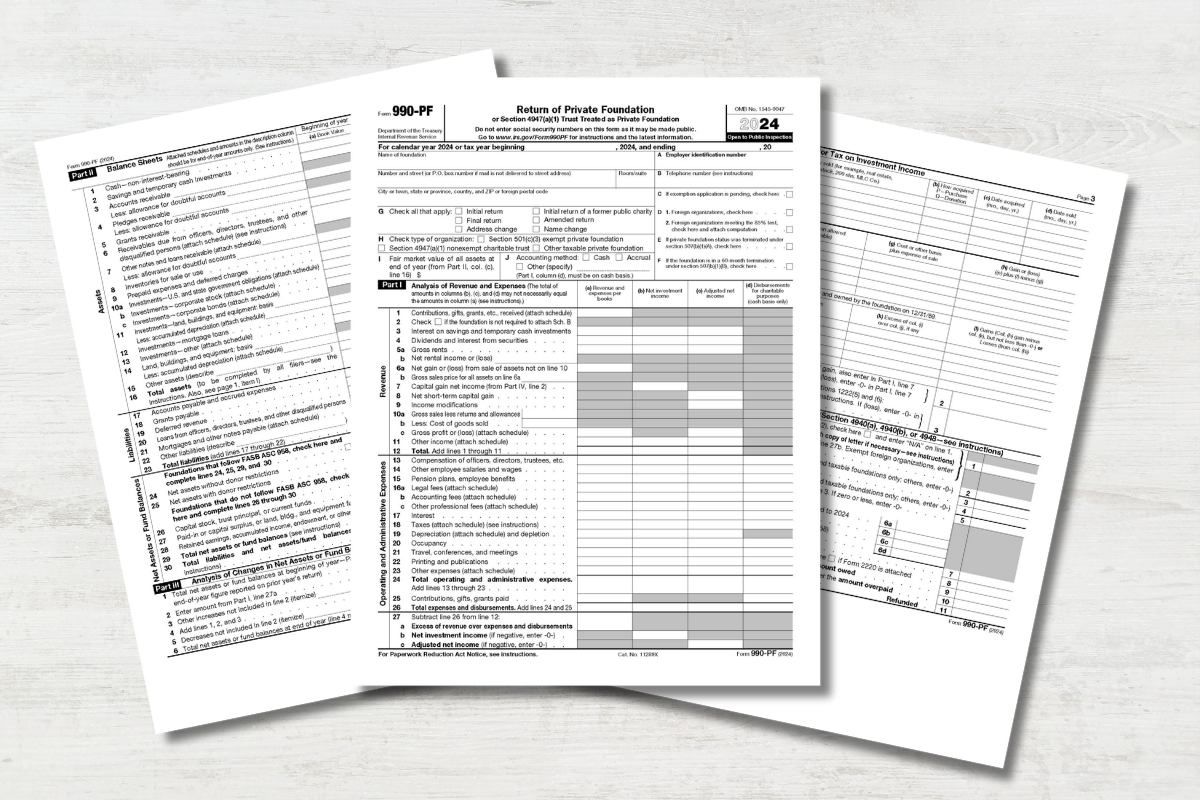

Preparing to File Form 990-PF: A Comprehensive Guide

Filing Form 990-PF can feel like a daunting task, but with the right preparation, it doesn’t have to be overwhelming. Whether you’re managing the filing process yourself or working with a professional, staying organized throughout the year will save time and reduce stress. This guide will walk you through how to categorize expenses, keep essential... Read More